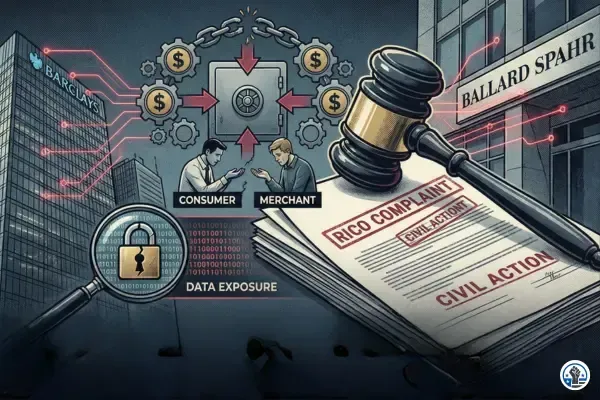

RICO Lawsuit: Barclays & Ballard Spahr Dispute Scheme

By Paige Elizabeth | Occupy Freedom

America’s consumer-protection system is not broken by accident. It has been deliberately weaponized by financial institutions and the law firms that shield them.

This week, Occupy Freedom PAC is supporting litigation that exposes a pattern consumers across the country have felt for years but have never seen fully documented:

the conversion of the dispute-resolution system into a corporate profit engine.

On Monday, Plaintiff Paige Elizabeth — a consumer-rights advocate and co-founder of this PAC — will file a landmark action against Barclays Bank Delaware and Ballard Spahr LLP, detailing a multi-year pattern of obstruction, data exposure, deceptive practices, and racketeering activity.

And the evidence speaks for itself.

The Scheme: How Banks Profit From Your Disputes

The complaint lays out the structure with precision:

1. A dual-deception mechanism that tells BOTH the consumer and the merchant they “lost” the same dispute.

This ensures the bank keeps the money.

Funds sit in internal accounts, quietly earning interest, float, and investment income — while the consumer is told the matter is closed.

RICO 11.20 big case

2. Automatic siding with merchants — even when services weren’t rendered or fraud is clear.

Not because merchants are right.

But because if the merchant “wins,” the bank keeps its interchange fees.

A merchant “loss” means the bank has to reverse those fees.

So they don’t let merchants lose.

RICO 11.20 big case

3. Removing state cases to federal court solely to stall.

Then leaving them in limbo for months.

This delays resolution, creates exhaustion, and forces consumers to give up.

Meanwhile, the bank continues to profit from the disputed funds.

RICO 11.20 big case

4. Weaponizing arbitration — not as a forum, but as a threat.

The complaint documents how Barclays and Ballard Spahr invoked arbitration only as a procedural cudgel — never as a genuine forum.

They litigated, removed, filed motions, and participated in the judicial process in ways fundamentally inconsistent with arbitration.

This demonstrates waiver, bad faith, and coercion.

RICO 11.20 big case

5. Publicly exposing private financial data.

Ballard Spahr filed unredacted personal and financial information in public court records — a reckless and unlawful disclosure that multiplied the harm.

RICO 11.20 big case

The RICO Enterprise: Why This Case Is Different

This is not “just” a dispute case.

The filings show a coordinated enterprise between the bank and its counsel — an association-in-fact — operating across state lines, using:

mail fraud

wire fraud

data exposure

obstruction

and procedural manipulation

to retain, invest, and profit from consumer funds.

RICO 11.20 big case

This is RICO.

And unlike a typical dispute, RICO targets the system, not just the transaction.

The enterprise had:

Shared goals

Delay consumer refunds → earn more float → protect interchange fees.

Shared methods

Coordinated communications, filings, removals, threats of arbitration, and misleading determinations.

Shared profits

Every day disputed funds sat in limbo, Barclays earned money. Every removal, delay, and procedural obstacle extended their yield window.

The complaint documents this pattern with the kind of clarity regulators have avoided for decades.

The Motion for Preliminary Injunction: Stopping the Damage Now

The injunction filing exposes the ongoing harm:

Barclays refuses to issue required Regulation Z provisional credits.

They threaten credit damage and collections while the disputes sit unresolved.

They continue to profit from the float during the litigation delay.

The motion seeks to freeze this machinery.

RICO 11.20.2

Specifically, it demands:

no investment of disputed funds

no credit reporting

no account closures, penalties, or retaliatory actions

and no using the federal removal as a pretext to derail the state cases

RICO 11.20 PROPOSED ORDER

This is the first step in cutting off the profit motive that fuels the entire scheme.

Why This Case Matters Nationally

This is bigger than one consumer.

It exposes a template used across the financial industry:

Delay

Confuse

Obstruct

Profit

The CFPB receives tens of thousands of similar complaints annually.

But none of those complaints connect the dots the way this litigation does:

that dispute systems have been redesigned not as consumer protections, but as revenue centers.

This case removes the veil.

What Occupy Freedom PAC Stands For

This PAC was built for moments exactly like this.

Corporate transparency

Digital and financial justice

Protection against systemic consumer abuse

Accountability for institutions that operate above the law

Barclays and Ballard Spahr are now on record.

Their pattern is documented.

Their actions are traceable.

And their conduct will be tested in court.

We stand with every consumer who has been lied to, stalled, ignored, or financially harmed by institutions that believe they are untouchable.

This case is not just about righting one wrong.

It’s about ending a system designed to make consumers lose — on purpose.